Where Do NY Property Tax Dollars Go: A Breakdown in Spending

O'Connor discusses a breakdown in where New York property tax dollars go.

NEW YORK, NY, UNITED STATES, September 30, 2025 /EINPresswire.com/ --Are New York property owners aware of where property tax money goes when the tax bill gets paid? Understanding the breakdown of the tax bill helps property owners connect the money to the services provided. Once owners know where the tax dollars go, they can hold elected officials accountable, have a better grasp on ballot propositions, and can make educated decisions when voting for changes in funding. Finally, good comprehension of the tax bill can allow owners to determine if they are getting value for the services. It may also serve as a deciding factor when they are looking at potential home buying options.

An exact breakdown of the tax money varies by county, city, town, or school district. However, property tax money typically goes towards the following:

Public Schools

Local Government Operations

County Services

Special Districts (libraries, garbage, water, etc.)

Public Safety (police, fire, etc.)

How Is Your Tax Bill Calculated

The property tax bill is the sum of several line items. Here is a step-by-step look into how the property tax bill is calculated.

Each local authority (school district, county, town or city, and any special districts) creates a budget. That budget decides how much money it needs to collect in property taxes, which is called the levy.

Tax rate = levy ÷ total taxable assessed value for that authority. It’s shown as dollars per $1,000 of value.

The assessor decides on the owner's home’s assessed value. Any exemptions the owner qualifies for (like STAR or the veteran’s exemption) are subtracted, leaving the taxable value.

Line item = authority’s rate × (taxable assessed value ÷ 1,000). Sum the line items to get the property tax bill.

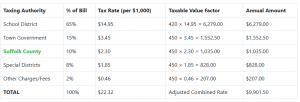

Example:

The following is an example using the steps above. Assessed value: $450,000

STAR Exemption (applies only to school tax): $30,000

Taxable value for school tax: $420,000

Taxable value for other taxing entities: $450,000

It is important to note that while the tax rate might be the same as your neighbor, your property tax bill may be higher or lower depending on your property’s taxable value and exemptions. Or you might have the same assessed value as a friend, but if you live in a different town, some of your local township or village tax rates may vary, resulting in a different tax bill amount.

The breakdown of property tax dollars can vary depending on the county, but the majority of property tax revenue supports public schools and essential services and programs. To be well-informed as a property owner in New York, make sure to review your tax bill or even local county budget reports for specifics in breakdown in your designated county.

While you may not have much say in setting property tax rates, beyond voting on ballot measures or choosing the town where you buy your home, you do still have some control over your own tax bill. As a homeowner, you have the right to challenge your property’s assessed value if you believe it is too high. This process, called filing a grievance, is your chance to appeal and possibly lower your bill so you are paying only your fair share.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in New York, Texas. Illinois, and Georgia. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.