Surety Market Size USD 22,332.32 Million in 2024 | Contract & Commercial Trends

The integration of advanced technologies like blockchain and AI into the surety industry is transforming the Surety Market.

Surety bonds are the backbone of project security, enabling businesses and governments to manage risk confidently and efficiently.

”

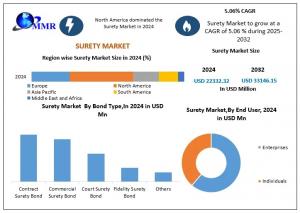

WILMINGTON, DE, UNITED STATES, October 1, 2025 /EINPresswire.com/ -- Surety Market was valued at USD 22,332.32 million in 2024 and is projected to grow at a CAGR of 5.06% through 2032, driven by infrastructure investments, AI-enabled underwriting, and rising demand across construction, commercial, and legal sectors.— Dharti Raut

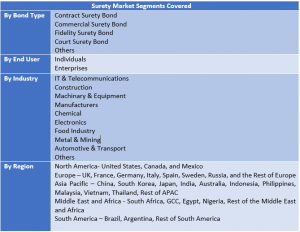

Surety Market is a cornerstone of financial risk management, enabling contractors, enterprises, and governments to execute projects with confidence while meeting critical surety bond requirements. Spanning contract, commercial, fidelity, and court surety bonds, the contract surety bond market dominates with roughly 58% market share, driven by construction and infrastructure demand. Enterprises lead usage, while SMEs increasingly leverage digital surety platforms to enhance credibility and access new contracts. Regionally, North America commands over 50% share due to a mature construction sector and strict regulations, Europe follows with 22%, and Asia Pacific is the fastest-growing region with rapid urbanization, infrastructure projects, and emerging surety frameworks in India, China, and Southeast Asia. Key players like Liberty Mutual, Chubb, Travelers, CNA Financial, and The Hartford dominate underwriting capacity, while smaller insurers and insurtech disruptors are accelerating digital transformation, adopting AI in risk assessment and automation in 60–76% of workflows, driving efficiency, accuracy, and faster approvals. Emerging commercial surety trends further expand market opportunities for both large enterprises and SMEs.

𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐢𝐧 𝐝𝐞𝐭𝐚𝐢𝐥𝐞𝐝 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬? 𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐟𝐨𝐫 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 : https://www.maximizemarketresearch.com/request-sample/185094/

AI Becomes the Underwriting Backbone in Surety Industry

Over 76% of insurers have already integrated generative AI into at least one business function, accelerating digital transformation in underwriting and claims. A recent industry survey reveals that 68% of insurance executives strongly support AI in risk assessment, while another 22% remain moderately favorable. In 2024 alone, nearly 74% of firms introduced new AI-enabled underwriting tools, reshaping how risk is evaluated and managed. For the Surety Market, this shift means faster approvals, reduced fraud, and enhanced accuracy in contract surety bond market modeling, building greater confidence among contractors, lenders, and government bodies.

Surety Bonds Gain Traction Through Digital Transformation

Alongside infrastructure momentum, the surety industry is undergoing a digital surety platforms revolution. More than 60% of bonding professionals have integrated AI and automation tools into their underwriting processes, while around 20% still rely on manual systems. Notably, 54% of underwriters now use AI-driven models to evaluate applicant risks, with 43% believing these models outperform traditional methods. This technological shift is transforming claims processing, reducing fraud exposure, and accelerating bond issuance timelines. As a result, surety bonds are becoming more accessible, efficient, and appealing not only to large enterprises but also to SMEs, further expanding the Surety Market’s competitive landscape and highlighting evolving commercial surety trends.

How Surety Bonds Morph Across Types to Serve Diverse Risks

Surety Market is segmented by bond type into contract surety bonds, commercial surety bonds, fidelity bonds, and court bonds, with the contract surety bond market leading usage due to its pivotal role in construction and infrastructure projects. In 2024, contract surety accounted for roughly 58.24% of the market, underlining its dominance in guaranteeing performance, payment, and bid compliance. Meanwhile, commercial surety bonds are gaining ground across licensing, leases, and service contracts, reflecting evolving commercial surety trends, and fidelity surety bonds are becoming more critical in sectors troubled by internal fraud. Court surety, used in legal settings for bail or appeal obligations, rounds out the mix. On the end-user front, enterprises remain the primary consumers of surety bonds, leveraging them to bid major contracts and meet regulatory surety bond requirements, while SMEs are increasingly adopting digital surety platforms to enhance credibility, secure contracts, and access new growth opportunities.

North America Rules, Asia-Pacific Charges Ahead in Surety Bonds

North America commands a dominant position in the Surety Market, accounting for just over 50% share, fueled by a mature construction sector and stringent regulatory norms that mandate bond-backed guarantees for public works and private contracts. Europe trails in second place with nearly 22% share, bolstered by harmonized EU regulations and strong infrastructure renewal programs. Meanwhile, Asia Pacific is emerging as the fastest-growing region: with rapid urbanization, renewed focus on infrastructure in India, China, and Southeast Asia, and the introduction of surety insurance frameworks in countries previously reliant on bank guarantees, the region is closing the gap. As governments adopt mandates requiring surety for project bids and regulatory pressures intensify in emerging economies, regional dynamics are reshaping the Surety Market challenging incumbents and opening avenues for new entrants.

Major Moves Reshape the Global Surety Market

June 13, 2024: Liberty Mutual Insurance announced an agreement to acquire JMalucelli Travelers Seguros S.A., a Colombian surety provider. This strategic move strengthens Liberty Mutual's presence in Latin America and expands its global surety operations.

March 13, 2024: Chubb CEO Evan Greenberg defended the company’s decision to issue a $91.6 million appeal bond to Donald Trump, highlighting Chubb's capacity to handle high-profile and complex surety bond transactions.

AI and Infrastructure Investments Propel Surety Market Evolution

Infrastructure-Driven Growth: Continued government funding and initiatives like the Infrastructure Investment and Jobs Act (IIJA) are channeling substantial capital into roads, bridges, energy systems, and smart city projects, boosting the demand for surety bonds across construction and infrastructure sectors.

Digital Transformation: About 60% of bonding professionals have integrated AI and automation into underwriting workflows, enhancing risk assessment accuracy, reducing processing time, and enabling providers to offer faster, more competitive bond solutions.

Surety Giants Face Digital Disruptors in Competitive Race

The Surety Market is led by global insurers like Liberty Mutual, Chubb, Travelers, CNA Financial, and The Hartford, who dominate with strong underwriting capacity, international networks, and diversified portfolios. These players are strengthening their positions through cross-border expansion and digital underwriting innovations, with Liberty Mutual pushing deeper into emerging markets and Chubb investing in AI-driven platforms. At the same time, smaller regional insurers and insurtech disruptors are intensifying competition by offering faster, automated bond issuance and niche solutions such as renewable energy project bonds. This dual force of established giants and agile challengers is reshaping the competitive landscape, where speed, flexibility, and technology are now the critical differentiators.

Surety Market Key Players

North America

The Travelers Indemnity Company (USA)

Liberty Mutual Insurance Group (USA)

Chubb Limited (USA)

CNA Financial Corporation (USA)

The Hartford Financial Services Group, Inc. (USA)

The Hanover Insurance Group (USA)

Old Republic Surety Company (USA)

RLI Corp (USA)

Great American Insurance Company (USA)

AmTrust Financial (USA)

Markel Corporation (USA)

Hudson Insurance Group (USA)

Merchants Bonding Company (USA)

Westfield (USA)

IAT Insurance Group (USA)

CapSpecialty, Inc. (USA)

United Fire & Casualty Company (USA)

FCCI Insurance Group (USA)

Everest Re Group, Ltd. (USA)

Arch Insurance Group (USA)

Europe

Coface (France)

Swiss Re (Switzerland)

Aon (UK)

Zurich Insurance Group (Switzerland)

AXA XL (France)

QBE Insurance Group Limited (Australia)

Asia Pacific

Tokio Marine HCC (Japan)

𝐅𝐨𝐫 𝐟𝐮𝐥𝐥 𝐚𝐜𝐜𝐞𝐬𝐬 𝐭𝐨 𝐭𝐡𝐞 𝐝𝐚𝐭𝐚, 𝐫𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 𝐧𝐨𝐰 : https://www.maximizemarketresearch.com/request-sample/185094/

Analyst Recommendation: Investors and market participants should focus on regions with rapid infrastructure growth, particularly Asia Pacific, while leveraging digital transformation in underwriting. Adopting AI-driven risk assessment and targeting SMEs alongside large enterprises can enhance market reach, efficiency, and profitability in the evolving surety market

Surety Market FAQs

Q1: What are surety bond requirements for businesses?

Ans: Surety bond requirements depend on the project type and jurisdiction. Businesses must meet financial, credit, and experience criteria to secure contract or commercial surety bonds, ensuring compliance and project performance. Digital surety platforms simplify this process for SMEs and large enterprises.

Q2: What is the contract surety bond market, and who uses it?

Ans: The contract surety bond market guarantees performance, payment, and bid compliance for construction and infrastructure projects. Enterprises dominate usage, while SMEs increasingly adopt digital surety platforms to access contracts and enhance credibility.

Q3: How is AI in risk assessment transforming the surety market?

Ans: AI in risk assessment improves underwriting accuracy, reduces fraud, and accelerates approvals. Around 60–76% of workflows in the surety industry now use AI-driven models, benefiting both large enterprises and SMEs.

Related Reports:

Surety Market: https://www.maximizemarketresearch.com/market-report/surety-market/185094/

About Us :

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Contact Us :

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

Lumawant Godage

MAXIMIZE MARKET RESEARCH PVT. LTD.

+ +91 96073 65656

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.